When dealing with Forex Markets on a daily basis, interest rates can have a strong impact upon the value of these trades, and play an important role to consider when dealing within the Forex market.

What are interest rates?

An interest rate is a charge which a person or corporate entity is subject to when using money, a rate that is often shown as an annual percentage of the amount borrowed, or the original investment, which is known as a principal. Typically, an rate is calculated by dividing the interest by the principal. The interest rates in the world are often changed by economic factors such as inflation, which can also have a huge and, sometimes, devastating impact upon the Forex market. To give an example of a 3% interest rate, if I borrow $1000 for the period of a year, at the end of the debt period, I am forced to pay the bank $1030, as £% of $1000 is $30. A common daily usage of interest rates occurs in the borrowing of money, such as loans, or in savings accounts.

Who sets the base rates in each of the G7 countries?

To first answer this question, it is useful to define who exactly composes the G7 group. The USA, UK, Japan, Canada, France, Germany and Italy, however the EU is often counted because it is an invitee of the G7. Each of the G7 countries sets its own base rate – with the exception of Eurozone members), but to understand this, it is important to know what exactly a base interest rate is. A base interest rate can be defined as the lowest rate of interest that a bank will accept for investing in a non-Treasury security. The deciding bodies of the base interest rates in each of the G7 countries are:

- USA – the FED (Federal Reserve System)

- UK – The Bank of England

- Canada – Bank of Canada

- Japan – Bank of Japan

- France – European Central Bank (ECB)

- Germany – (ECB)

- Italy – (ECB)

What would drive a base change in the base interest rate?

Base rate changes based on each individual countries’ financial situation, for example, should a country be in an economic crisis, less people are willing to borrow money or start a business, and so a central bank may drop an interest rate by a few percentage points, in order to essentially put money ‘on sale’ – thus encouraging a continually flowing economy rather than a drowning, stagnated economy that is bad for business. When times are good, interest rates grow as more people wish to start new companies and have the financial security to take out loans, and so the bank can drive prices up. Interest rates across the world, thanks to increasing globalization, are tied closely together, and this is a reason as to which an economic crisis (such as that of 2008) can impact a whole number of countries, rather than just one. Central banks often meet a few times a year to decide interest rates, for example, both the FED and the Bank of England meet eight times a year.

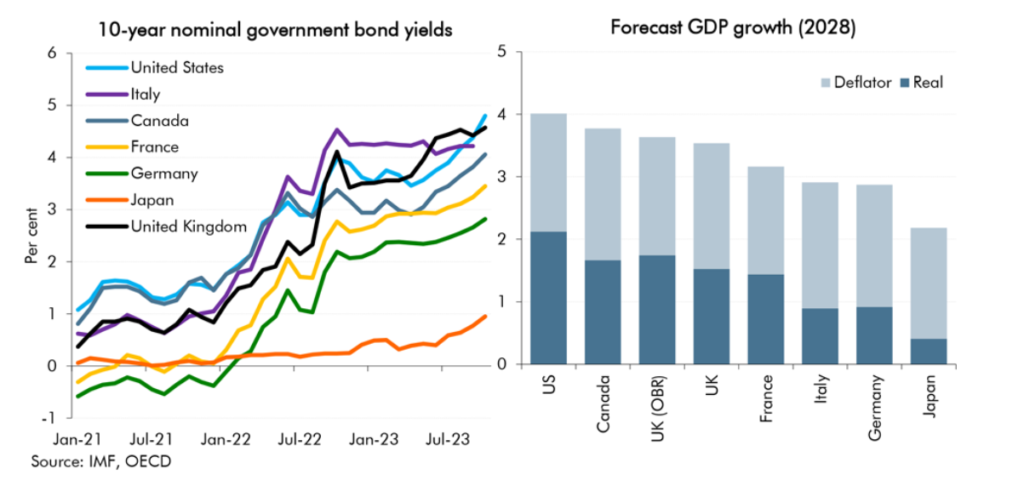

How have the interest rates in each of the G7 countries changed since 1970?

- The UK – In the UK, interest rates since 1970 have changed considerably, with a peak of 17% in 1979, however in the last decade interest rates have stayed at a horrific 3% or less.

- The USA – In 1974 the USA had a base interest rate of 9%, however the interest rates of the country have ultimately been pretty stable until 1994, where they came crashing down to just 3%, and with a few dips and troughs over the last two decades have now sunk to an all time low of less than 1%.

- Canada – In Canada the peak of the 1970s was also a high point of interest rates, with a similar 16% gracing the country, though this too has fallen over the years, with an ultimate low of 0.25% in 2008. It has since picked up a little, however still remains below 2%.

- Japan – The interest rates of Japan trended lower than the Western countries during the 1970s, reaching an ultimate high of just 9%. Furthermore, it is one of the only nations in this list to have reached a negative interest rate of -0.1%, which the country currently retains as its national interest rate.

- The ECB – The European Central Bank controls the interest rates of the Eurozone, and as the currency is newly minted, it is impossible to look up the interest rates from before 1999. In 2000 the interest rates reached a high of 4.25%, however it currently rests at a low -0.5% – even lower than that of Japan.

What impact have interest rates had on currencies?

Ultimately, higher interest rates increase the value of a currency, as hot money flows mean that investors are more likely to save money in American banks if they have the highest available interest rates. A stronger dollar makes US exports less competitive, reducing the exports and increasing the imports to the country, therefore reducing the aggregate demand of the country. A country, for example, may choose to increase its interest rates in order to protect the currency from devaluing strongly, which would put national businesses at a disadvantage on a world trade stage.

How do interest rates impact Forex trade?

Interest rates can impact Forex trade, because fundamentally, Forex markets are tracking the interest and value fluctuations between two different currencies. This, therefore, means that there is a direct link between the interest rates of different countries and their trading values, and as a Forex market worker, it can be beneficial to keep an eye out for sign that interest rates will change, for example, looking at employment levels and house prices within a country can help you to understand exactly how the interest rate will shift – and make advance economic choices in order to take advantage of the shifting values. Furthermore, it is incredibly good practice to keep an eye on announcements of each of the central banks, as ultimately the actual interest rates are what impacts Forex trading – not the predicted ones. Should there be a shocking new announcement of a change in interest, it is a fantastic opportunity to be ahead of the game in a Forex market and, fundamentally, make money off the fluctuating values of different currencies.

When dealing in Forex trading, the most important aspect is to continually stay politically and economically up-to-date, in order to spot potential trends, whilst also staying flexible enough to monetize off the sometimes rapid and daily changes.