A beginnners guide to Day Trading Foreign Exchange Markets, what is the process, who does it and what are the risk – and hopefully Rewards and Profitability of Day Trading.

The Global Forex Market is a 24 hour de centralised marketplace where participants vary from Government’s to Central Banks, Multi-Nationals corporations to small and medium size import/export business’s and most commonly to Investors and Speculators. All participants add to the daily trading volume of up to $7 Trillion a day in activity. This is the total value of buys and sells and matched trades in a market that is constantly moving.

Day Traders are those speculators, be it a small ‘man/woman in the street’ with their $100 online Trading Account to the Hedge Fund Manager with Assets Under Management (AUM) of $500m are all trying to do the same thing, benefit from the small price movements in prices by predicting when a market is going up (getting stronger) or going down (getting weaker). Buy LOW, Sell HIGH. The oldest game in the business.

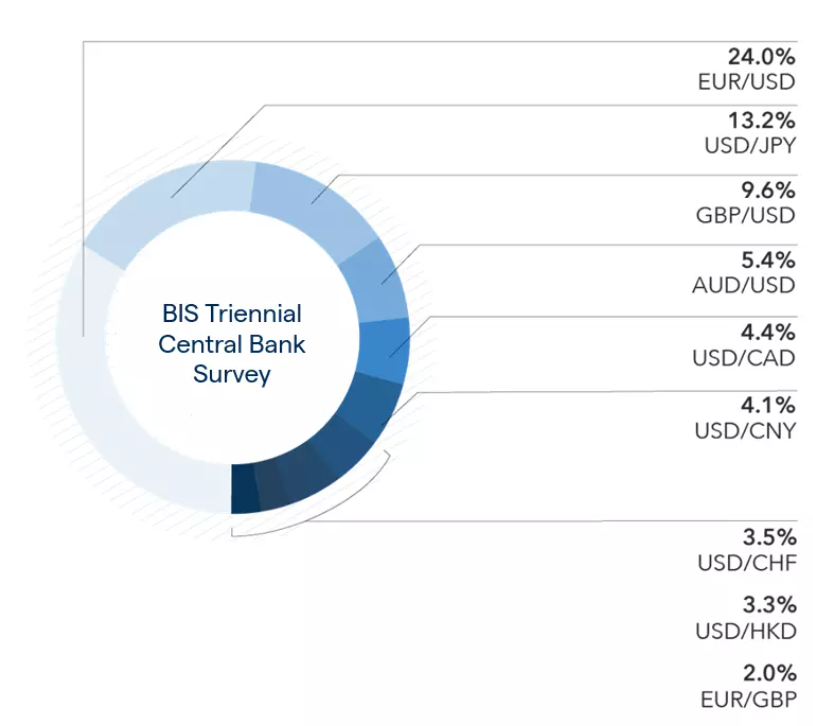

According to the Bank of International Settlements (2022, survey) the most actively traded Currency Pairs are as follows:

The most active currencies are said to have the most ‘liquidity’ and as such are ‘safer’ to trade and have tighter, more competitive and as such ‘cheaper’ spreads.

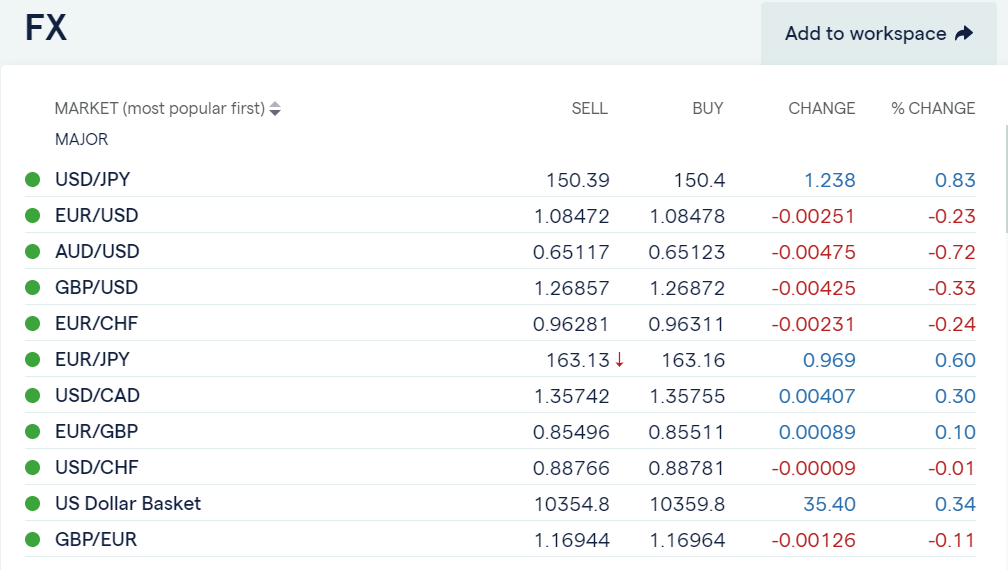

Go onto any trading platform and you will see a list of these ‘currency pairs’, as such:

* All tables, charts and illustrations in this article are from IG Markets Trading Platform www.ig.com

This table reflects the current price available at this moment inn time and could be referred to as the ‘live’ market price. Each price having a Bid – the price the broker will Buy off you at (you SELL) and the Offer – the price they will Sell to you at (you BUY) – as indicated by the two columns.

As you can see there is a price difference. This is called a ‘spread’ and is effectively the ‘cost’ of transaction.

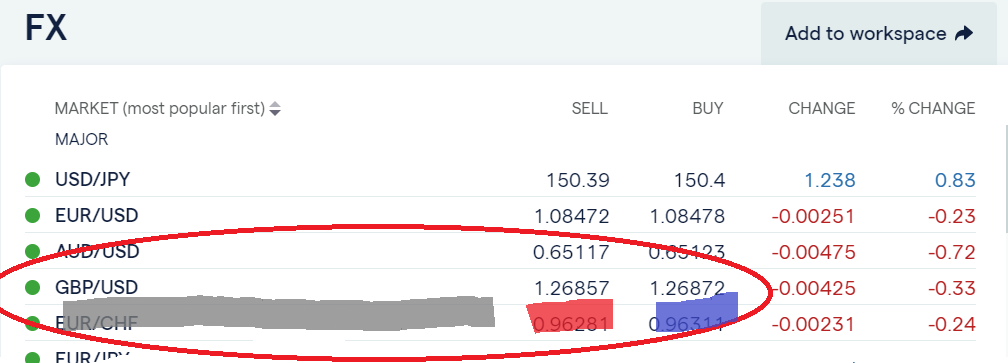

If you look at the Price of the GBP/USD rate highlighted you will see that the SELL Price (BID) is 1.26857. That means the best price you can Sell the British Pound at is 1.26857 or $1 and 26.867cents for every £1.

If you are agreeing to do this for £100,000, then the receipts would be $ 126, 857. Somone who is speculating that the British Pound was to weaken (go down) against the US$ would be a Seller. If they thought the British Pound was to strengthen (go up) they would be a Buyer. A Buyer in this instance would have to pay $ 1.26872, the Offer and Buy price quoted.

As discussed, Day Traders are looking to benefit from price movements in any given currency pair over a given period of time. As the following chart show, the daily movement of the British Pound/US$ Cross rate (GBPUSD) can vary enormously over time.

Each Bar here, represents the market price on any given day. The GREEN bars indicate that the market price went UP during that day. The RED shows a day when the market weakened and went down.

AS you can see in the last 8 trading days, the market has gone down 7 days out of 8, with a small ‘up’ day, 6 days ago, with the market falling from around 1.2870 to the current 1.26865. That is the GBP weakening, the $ Strengthening.

For example, if you had sold the GBP at 1.2870, 8 days ago for £100,000, you would have received $128,800 for the Trade.

If you wanted to buy that £100,000 back today, you would pay $126,685 at this current moment in snapshot.

That’s a P&L of:

OUT £100,000 IN £ 100,000 Net £ 0,00

IN $ 128, 700 OUT $ 126,865 Net $ 1,835 Profit

This of course has taken EIGHT days to materialise as a profitable Trade.

What Day Traders are looking to do is look at Hourly, or even small ‘time frames’ in which to trade. An hourly Chart in this same period, looks like this:

Whilst some will look at time frames as small as 1- 2 minutes. This chart is a 5-minute chart of the same GBPUSD Market:

When a Day Trader is taking a ‘view’ (having an Opinion) whether to be Long (to Buy) or Short (to Sell) his Objectives for the ‘trade’ is likely to be much shorter than that of a medium term Trader is is looking to hold on to a ‘position’ for longer – maybe days or even weeks.

A Day Trader may only be looking for the next 10 ticks. That I to say Buying at 1.2685, looking for the next 10 ticks UP, or a market price of 1.2695 where they can take Profit!

A 10 tick profit on a similar £100,000 Trade is ($126,950 – $126,850) $100 or $10 per tick. Similarly, of course a 10 tick drop would result in a $100 LOSS – something a Day Trader needs to try and avoid. As you can see, the market can be very volatile, with prices moving constantly and sometimes very fast. Strict Risk Management is the most important aspect of Day Trading a trader needs to learn and most importantly practice if the are ever going to make money on a long term basis.

Understanding the Dynamics of the Forex Market for Day Trading

A thorough understanding of the market’s dynamics and the main factors driving market movements is essential if you want to make money Day Trading Forex. In short:

- Focus on 1 or 2 Currency Pairs Only – preferably non synergized or non corelated.

- Understand what the Interest Rates are in each currency and the rate differentials.

- Be aware of any upcoming Key Economic Indicators upcoming that might affect these currencies.

- Study and have a good understanding of the relative strength of the Economic welfare of each nation – for instance the UK and US Economies, and the expectations for each if trading GBPUSD

A study of the above can be described as Fundamental Analysis

Intraday traders also monitor ‘technical’ indicators (like the above charts) to gain insight into the market sentiment (in any given time frame) and possible future price development.

A Solid insight into what moves the markets- from both a fundamental and technical analysis enables the trader to identify the most favorable opportunities and make informed trading decisions.

A Disciplined Systematic Approach for Intraday Trading

The first and most important ‘starting point’ for ANY trader is to UNDERSTAND risk and how that risk is going to affect their trading and decision market. From Day 1 you need to develop a process of when, how and for how much you are going to trade, where your STOP your losses (Stop Loss) and where your market expectations are and when you want to take profit.

You can ONLY do this by studying and understanding how YOUR market works and trades. What a typical trading day looks like (what is the Average Daily Range etc), what drives the markets, what are the key time frames etc. Really understanding the day-to-day realities of trading a currency pair.

Then you build your trading style around that understanding – and then STUDY your trades – the winners and losers (and scratches) and understand the STRENGTHS and WEAKNESSES of your approach and most importantly YOUR Risk Management – if you have any!!!

Only over time – and it may take months if not years – can you fully understand HOW YOU personally react to the markets – when you perform best and what works best for you. You WILL make a mistake. You WILL have losing trades – LOTS OF LOSING trades. Its normal. It how you learn from those trades, improve your decision making and risk management that will be the basis of the ‘disciplined, systematic approach’ that you will define for YOURSELF.

In summary you can say:

Discipline: Trading without a systematic and disciplined approach is essentially gambling. Without such trading the markets successfully in any time frame is next to impossible.

Monitoring: By understanding and studying YOUR Market effectively and to the required depth A trader will learn to monitor prices during certain periods without acting on emotions and making reckless decisions – because there SHOULD be ‘no surprises’ – even if you haven’t called the market right. You should at least understand why a market has moved why is has – and not ‘react’ with sticking t0 your ‘disciplined’ process of Entry and Risk Management.

As such, you will have a :

Strategy: follow a set trading strategy that clearly specifies the conditions for entering the market. DO NOT just turn on your screen, open up your platform and just trade!!!!. You should study the market based on the parameters set out in his strategy and only act when a set up meets these rules of entry.

The biggest thing to avoid is to be ‘reactionary’ whereby you react when the markets move vigorously and place trades to ‘get in on the action’. Similarly, DO NOT get stopped out, taking a pre-defined and anticipated loss, only to get straight back in the market – with the same position – fighting against the grain.

Sticking to one’s trading plan can be challenging and requires discipline. But it’s the only way to stick to a process that you can then study and learn from.