At a time when trading Forex is as easy as opening your phone and clicking a Buy or Sell button, trading Options seems a mystery to most. So what are Forex Options? Why do most Professional Bank & Hedge Funds traders prefer Options over Cash? And are Forex Options really accessible to the ‘average’ trader/investor?

Certainly, in answer to the last question, are Forex Options accessible, I can give you a resounding YES!

Forex Options are not only useful as a hedging tool but also an opportunity to achieve great leverage (Bang for your Buck!!), amazing returns and all in a truly limited risk market!!

But of course, there are limitations. There are dangers! And, with all financial products and especially derivatives ALL of your capital is at risk and if you call the market wrong, you are going to LOSE money. But let us not get too negative. Once you have learned the basics of Options and start to see the benefits you will begin to appreciate their power.

Options – The Basics……

Currency Options grant the holder or buyer of an option the right but not the obligation to Buy or Sell a chosen currency pair at a set price, agreed today, at some pre-determined date in the future. Wooh!!! I can hear you say. That’s one heck of a definition and maybe a bit too much to take in on the face of it. So forget FOREX, let’s define Options in the ‘real world’

Imagine, walking into a BMW showroom and seeing a beautiful new 4 Series BMW ( a nice Red Sports Car if you are not a petrol head).

Looking at this beautiful piece of German artistry, you may think ‘this time next year…………..’ when the salesman wanders up, as if reading your mind, and says, “sir/madam, would you like to buy? Only $35,000! Quite the bargain, if you don’t mind me saying” and you just shrug and reply ‘this time next year…………………. perhaps (?)”

And the Salesman says, “well I’m not sure what price the car will be ‘this time next year’ but if you want to pay a small deposit, I will guarantee to Sell one for you at $36,000 even if it’s even higher on the day, which it most certainly will be. But only for a year, mind. Anytime up until a year today I will stand by this offer”.

In essence, the dealer is granting/giving you the option to buy, at a fixed price agreed now ($36,000), with a year expiry on the deal. For this, he will charge you a small non-refundable deposit of let’s say $350 (1% of today’s price).

How would this Option look like?

If the Salesman handed you a ‘receipt’ on the ‘Option’ he has just granted to you it may well look something like this:

ALL Options will have similar if not exactly the same characteristics. Namely,

- An Execution Date – The day the transaction was agreed

- An Underlying Asset – In this instance – the BMW car

- Either a Buy (Call) or Sell Put – whether this Option is to Buy or Sell the Asset

- Strike Price – The price you, as the holder of the Buy Option, can buy the car at, at any time up to expiry, if you want to

- Option Expiry – The day the Option literally expires and has no more value

- Premium – the cost of buying this Option, not unlike an Insurance Premium

In summary, you have a piece of paper (a contract ) which grants you the RIGHT but not the OBLIGATION to buy a BMW 4 series at $36,000 within 1 year. In exactly 1 year (March 10th, 2021 as per this example) this Option will expire and will not be valid anymore.

What can you do with the Option?

As of today, with the Cash price of the car $ 35,000 you would just hold onto it. Let’s remember, that for the purposes of this example you bought this ‘option’ in the hope that you would be in the financial position in 1 year’s time to hopefully buy the car. Flash forward 1 year and let us assume you now have the $36,000. Would you want to take-up (or ‘execute’) the Option if the cash price of the same car was now $34,000? or even $35.000? The reality is, if the ‘cash’ price of that car is anything less than $36,000 then you will not exercise the option. Conversely, if the cash price is above $36,000 then obviously it would be beneficial for you to take up the option and exercise it.

Forex Options

Forex Options work very much in the same was. As complicated as they may seem, Options are actually very easy to understand. Once you visualize them in the same ‘everyday’ environment as our BMW example you will find them very logical to follow and trade.

To de-mystify Forex Options and all Options, in fact, you should familiarise yourself with some of the basic terms and jargon.

The Easy Guide to Options Definitions

Holder of an Option The Buyer – The person or entity who holds the rights to Buy or Sell a Currency Pair in the future

Granter of an Option The Seller – Issuer of the option to give the rights of the Buyer to Buy or Seller of the currency pair in the Future

A Call Option The Right to Buy a currency pair in the Future

A Put Option The Right to Sell a currency pair in the Future

The Principle The amount of the Base currency that you will either Buy or Sell

The Strike Price The ‘price’ of the Currency Pair where the exchange will be struck at some date in the future

The Premium The cost of the ‘Options’ paid by the Buyer of the Option to the Seller

The Value/Expiry Date The Date that the Option Expires

The Underlying Asset Usually the ‘spot’ rate if the given pair on the ‘value’ date

Expiry Date In most instances there is a ‘cash’ settlement but in some cases, the physical currency may deliverable

How does a Forex Option differ to Spot Forex?

Compared to a Spot or Forward Agreement, where the terms of the deal are clearly laid out the transaction is executed for immediate settlement, when you are a buy of an Option you do not have to execute the terms of this agreement unless if it is beneficial to do so.

For example:

A trader buys the following Option, with the following specifications:

Trade Date: March 20th, 2020

Amount: £ 5,000,000

Pair: GPB/USD

Type: Call Option

Value Date: September 5th, 2020

Strike Price: 1.3500

Premium: 1.25 (or 125 pips)

underlying asset price at the time of purchase GBP/USD 1.3200

Option Summary

This Option can be described in simplistic terms as a:

British Pound “Out-of-the – Money” Call Option for September 5th

This reflects the fact that with the current ‘spot’ price being at 1.32, some 3 cents below the Options strike price of 1.35, there is no ‘real’ or ‘intrinsic’ value in the Option. However, the underlying asset of this option is the ‘forward’ price of the GBP/USD for September 5th. This value could well go up (and down) between now (March 20th) and the expiry/Value Date.

What Happens at Option Expiry?

Fast forward to September 5th and the actions of the holder are quite simple. If the ‘spot’ market for that date is 1.3500 or higher, and the Option has some value, they will of course ‘execute’ the option. In doing this they would Buy the £ 5,000,000 at 1.3500. They can then either hold the Trade or sell immediately in the Spot Market, booking the profit*.

If the Spot Market is Below 1.3500, the holder will do nothing. There is no value in Buying £5,000,000 at the 1.3500 Strike price when they can buy cheaper in the Spot market.

A Put Options works in very much the same way. The holder of a Put has the right (but not the obligation) to Sell the currency pair at the Strike Price agreed.

* Of course, the ‘real’ profit on the Trade is above the ‘break-even’ which is the Strike Price of 1.3500 + the cost of the Option (premium) of 1.25, therefore 1.3625. However, you would still execute the But Option above 1.35 an extract and value you can to offset against the cost.

How are Currency Options Priced and Traded?

For the purposes of the overview, I will try and keep things simple. For a more detailed explanation please look at our article ‘Currency Options – A beginners Guide to Pricing & Trading Strategies’ which covers the subject in more detail.

In simplistic terms and as we have touched on already Options fall into three categories:

At-The- Money Where the ‘strike’ Price of an Option is very close or at the price of the underlying asset

Out-of-the-Money Where the ‘strike’ price of a CALL is above the current ‘market’ price of the underlying asset. In the case of a Put Option, when the ‘strike’ price is below the market price

In-the-Money Where the Strike on a Call is below the current market or the Strike on the Put is above the current market and these options could be said to have some intrinsic value.

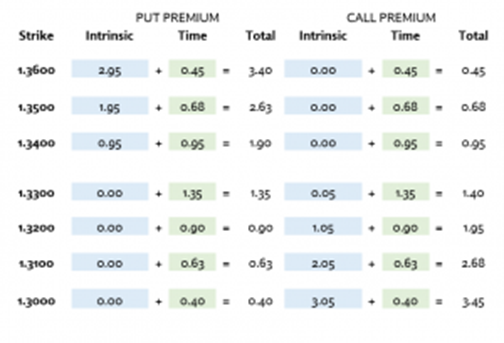

The above table clearly shows how an Option will be in, out or at-the-money.

The 1.3600 Puts (the right to Sell @ 1.3600) has a very high premium reflecting that being Short at 1.3600 you would have a lot of profit built-in. The current market is 1.3305 so you have 295 pips of ‘value’ or profit instantly. This is called ‘Intrinsic Value’ and is a key component in an Options Value or ‘premium.

An option ‘premium’ consists of two variables:

Let us have a look at a ‘strip’ of Option prices. The table shows GBP/USD pair for a September 1st expiry. These are (near) 6-month Options with a current Underlying Asset Price of1.3305 (the price of the September 1st Forward on GBP/USD)

As you can see the value of 3.40 is given for the 1.3600 Put which is broken down as the 2.95 (or 296 pips) of Intrinsic value, this being:

Strike Price of 1.35000 – Asset Price of 1.3305 – 295 + Time Premium of 45 = Total 340

The 1.3600 Call Options has Zero Intrinsic Value but the same Time Value of 45 = Total 45

- As the Underlying Market rises, the cost of a Call Option increases, and a Put decrease.

- As the Underlying Market falls, so do Call option premiums, whilst Put options increase.

How to Make Money Trading Currency Options

A Currency Option can be traded all the way up to the expiry. A speculator may think that the GBP/USD cross rate is going to trade higher in the coming weeks. To benefit from such a move he may use Options, buying a Call option for example. As the market rises, so will the value of the call Option, making the buyer a profit.

The ONLY RISK in Buying Options is the cost of the Premium – which you can lose in its entirety. The cost of the option is the premium x the Execution Amount.

So a £100,000 1.3300 Call Option (Premium of 0.0045) would cost

£ 100,000 x 0.0045 = $ 450.00

If the Underlying Market is 1.3400 at expiry, the 1.3300 call will be worth 0.0100, a profit of 0.0055 ticks, or $550 profit.

When the market is at 1.3500, the profit would be $1,550, at 1.3600 – $2, 550 and so on.

Should the market is anything below 1.3300, and as such the Option expires worthless, the maximum loss is the $450 paid in premium.

There are many other strategies that Speculators, Hedgers and Risk Managers use currency options. Again, I strongly urge you to check out our article ‘Currency Options – A beginners Guide to Pricing & Trading Strategies’ which covers the subject in more detail.